The Price of Peace?

Here's some financial speculation for you.

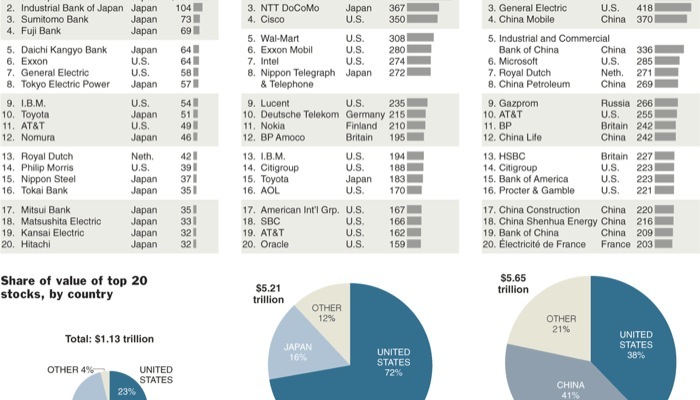

The above image comes from a New York Times piece on China's stock market and how it is almost certainly overvalued (Note that you'll probably go bankrupt trying to predict when it will crash).

The

article got me thinking: over the last 18 years, the value of the top

20 companies grew at a 9.4% CAGR. (For perspective, the

historical return on equities is about 7.5% since the '30s-I'm going to

assume it's similar for all stocks between 1989-2007). This means

that the top-end is growing faster than the rest.

Why

might this be happening? A couple of perennial contenders:

deregulation and the fact that companies spent a lot on IT in the 80's

but it didn't show up in share prices until the '90s. But what

about "peace"?

1989

saw the Cold War winding down as it became apparent that the USSR was

not going to create WW III. Deng Xiaoping has started reforming

China in 1984 ("Socialism with Chinese Characteristics") and within a

few years, India could no longer turn to the USSR as a legitimate

economic model.

Is the Chinese bubble we're seeing right now the long-term peace dividend from the Cold War? Can we use this bubble (and the price readjustments that will occur down the road) to "price" what peace in the Middle East might mean? If a peace accord was in place, could we expect to see an Israeli high-tech company, a Dubai property developer, an Iranian oil company and an Iraqi textiles company in the top 20 most valuable companies of 2027?

Saturday, October 20, 2007