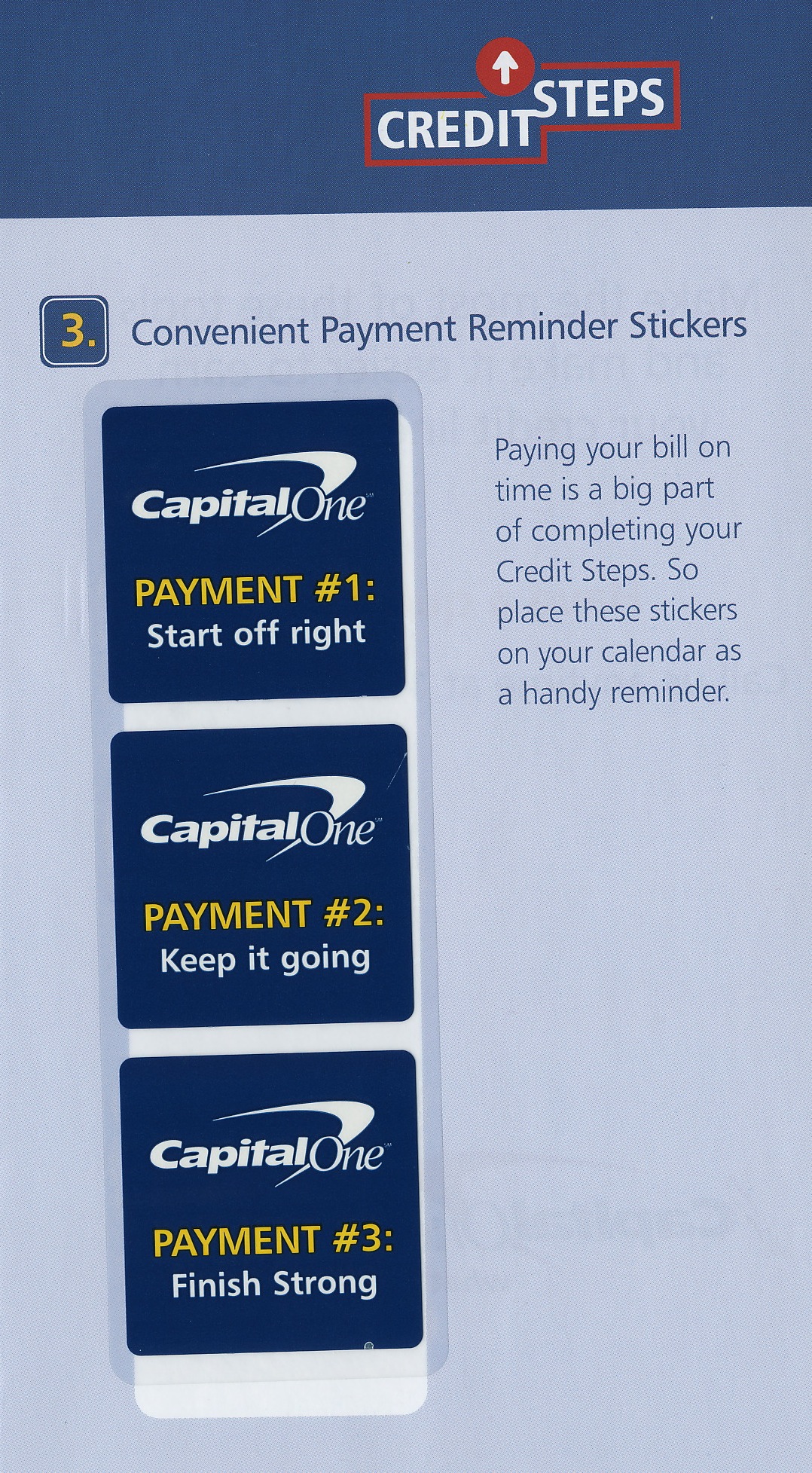

I recently got a credit card from Capital One and shortly after it arrived I received a brochure from them that contained the following:

These are three stickers that I'm supposed to put on my calendar to remind myself to pay my credit card bill. Am I the only one who finds this a little weird?

Think about it. You're a credit card company. You are basically lending people money with the trust that they will pay it back. If you want to avoid losing money you try and find the one's most likely to pay their bills. Those folks don't need stickers for their calendars.

But then you get greedy. You decide that you can make a lot more money if you can find people who will actually pay their bills, but do so late-because then you make money on interests charges and late fees. These people are a lot riskier-how can you accurately model who is going to pay their bill late versus never pay at all? In order to appear as a good corporate citizen who helps people become financially responsible, you give them stickers. And if it all blows up, at least this way you can tell shareholders and Congress that you were trying to help people become financially responsible, right?

So here's my suggestion. The next time you sign up for anything that has a monthly payment plan and you receive sticker, short that company's stock. And get your money out of the stock market. For evidence with a sample size of one, here's Capital One's ticker; down 60% from it's peak and has gone nowhere for five years: