It has been a fascinating few weeks in the device-side of the mobile internet. A ton of major events have happened. It worth looking at them all to try and figure out the patterns and understand what's going on.

Item 1: Blackberry unveils preview of OS 6

Blackberry released a video showing what their new OS 6 is going to look like. It's worth worth watching, because it's a bet-the-company move.

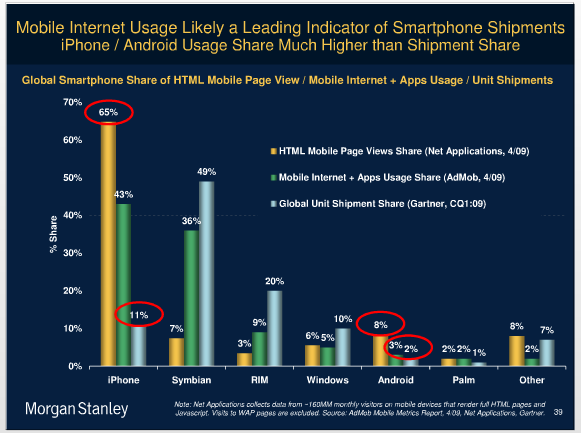

Why is this a bet the company move? Take a look at there charts from recent Mary Meeker state of the internet reports.

This first one is from 04/09 and shows the share of handset shipments vs. usage for different manufacturers. One way to read this is that if your usage is higher than your shipment share then people love using your phones. And if people love using your phones, you're probably going to keep growing.

So how does RIM do? Not well. Lots of shipments, but very low relative usage:

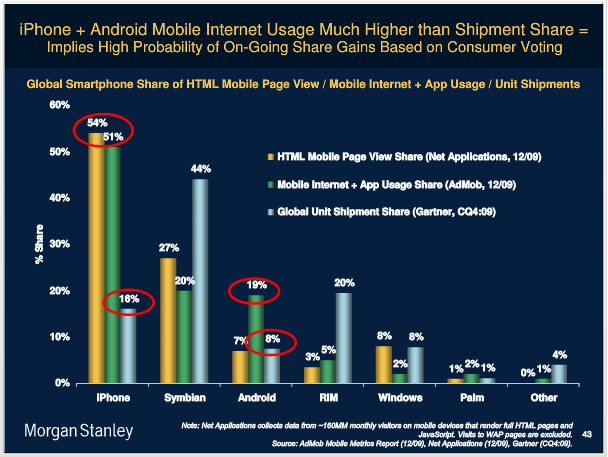

Here's an updated version from the end of 2009. RIM's slipping on usage - Android has jumped ahead of them - but they're holding firm on shipments.

The scary thing for RIM right now is that they have to get people to use the mobile web on their phones. That's why the video above shows Facebook, Twitter and a bunch of other web properties on the new OS 6. If RIM can't get people to use the web on their phones, no developers are going to build for their platform and then it's a vicious cycle to the bottom.

Worse, RIM will still look financially good as they've got a massive salesforce and are still the leaders in integrating with corporate email systems. They've also got great relationships with the carriers so they'll be able to use price to ship a lot of units. They'll even throw off a lot of cash in the meantime but it will be like watching GM's arc from 1960-2010. I'll keep watching the graph above: if it doesn't shift, they are doomed.

The battle for smart phones used to be about who was the best at selling high-priced devices to corporations (the only ones who could afford them). RIM won by having a great keyboard and Exchange email integration. But Apple redefined the space and made it a consumer game - which will be won by whoever has the most intersting apps on their platform.

Which brings us to...

Item 2: Some Guy Named Steve's Thoughts on Flash

This morning Steve Jobs wrote a post where he explained why Apple will not support Flash on the iPlatform. It's a beautiful piece because it is the intersection of deep technical knowledge and keen insights on business strategy. Even if you know nothing about Flash or technology, you can appreciate the letter.

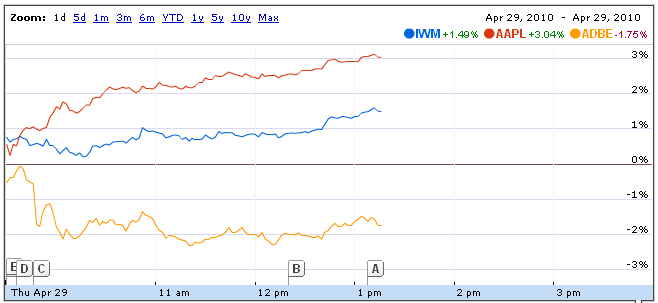

The implications are striking. Flash is dead as a technology for anything other than lazily creating websites for small businesses. The market seems to understand this:

So what are the implications for software developers?

First, if you're on Flash, migrate away from it as fast as you can. Similarly, migrate away from any software tool that uses anything other than web standards to enable you to code across platforms (and even then be wary).

Second, focus on making your data clean and creating an API. If you don't have the resources to develop across multiple platforms (after all, you were using Flash for that), you need to convince someone to do it for you. Give them access to your data and let them go to town.

Adobe got whacked by the Apple stick today as Apple reaffirmed their focus on their platform. But Apple doesn't just take away, Steve giveth too...

Item 3: The Crazy Pricing of Apple's iAds

The Business Insider is claiming, courtesy of the WSJ, that Apple is looking to price its iAds at 10X the traditional price of ads. They're going to charge $0.01/impression and $2.00 per click (!). They keep 40%; the developer of the software program keeps the rest.

Why is Apple charging so much for this? Well first, they're the only game in town (see Item 2) so they can. More importantly though, 60% x $2.00 = $1.20. That's a huge amount of money for a developer - particularly given that the average price of an iPhone app is $2.40.

You can bet that many more developers are going to be clamoring to put these ads in their applications. Which means that more people will be trying to develop for the iPhone. Which means that more people will buy and use the iPhone as it has the coolest, best apps. Go take a look at item #1 again and you can see why it's RIM's bet-the-company moment.

There's no way Apple will sustain this pricing over the long haul, but it might be enough to kick RIM or Symbian out of the game. Especially since Palm's now gone...

Item 4: What the Hell is HP Doing?

The last major event of the past few weeks (at least, at the time of writing this) is HP buying Palm. HP's got a long history in the mobile space (remember the iPaq or the Jornada?) and now they're "doubling down on the Web OS [Palm's operating system]."

Many people assume that they're doing this to re-enter the hot mobile space, etc. but I'll bet $5 it's for the following:

1) HP has been at risk of getting 'stuck' as a computer manufacturer. They make middle-of-the-road devices and the market is fragmenting to the high- and the low-end. By buying the WebOS they can build some cheaper and/or differentiated devices like netbooks, tablets, etc. without having to pay about $40/unit to Microsoft for a copy of Windows. (They already make high-end [and high margin] devices like the Blackbird and VoodooPC)

This is augmented by the fact that software is shifting to the Web: you use your browser, Facebook and Twitter - and you don't care if the underlying platform is Windows or WebOS.

2) You're going to see a whole lot of WebOS systems in the government and enterprise. Remember that HP has a massive consulting organization. The Web means that this group increasingly spends its time moving bits around its clients' organizations; that's where the money is. Now they can offer linux-based devices on the server side and WebOS-based devices on the client side, meaning that an HP offering just got cheaper than the competition.

Don't be surprised if 5 years from now you go to your doctor's office or local fire department and everyone's using an iPaq Palm device.

3) What you won't see is a great phone. Palm hasn't shown themselves good at picking carrier partners (witness the long exclusivity to Spring) and HP doesn't sell phones, so don't expect them to do a good job either. Also, Palm's never going to beat Apple or Android on the software side; they lack the scale and focus to do so.

There are going to be a lot of devices that use the WebOS but the developers are going to be working on commercial apps for industry (think medical records) or HP will be paying the Facebooks, Twitters, etc. of the world to create versions of their apps on the WebOS platform.

As the Chinese say, may you live in interesting times...